Emergency Fund

Cusco, Peru

An essential part of your financial plan is to have an emergency fund that should be equivalent to three to six months of bills. Life is unexpected, as we have seen with the recent coronavirus pandemic, and there could be times when you are not producing income. These reasons could be taking care of a loved one, illness, another pandemic, or an unexpected layoff. Having an emergency fund will allow you to feel more secure knowing that expenses are covered until you have secured new employment or disability insurance begins. Also, there will be times when your current job will not be suitable for you for various reasons. You will have the necessary funding to seek new employment and improve your situation by having an emergency fund. If you do not have an emergency fund, you risk losing your apartment or home, credit card debt, and an inability to pay for basic needs. Not having an emergency fund could be an extremely stressful situation that could further lead to depression and anxiety, affecting many aspects of your life. Save for your emergency fund in conjunction with investing in your 401K and after you have paid off high-interest debt such as credit card debt or personal loans. Do not feel discouraged that you do not yet have the three to six months of bills needed in your emergency fund. Your financial plan is a lifelong journey; find solace knowing that you are moving in the right direction.

Two Methods on How to Budget and Build Wealth

New Zealand

Personal finance can be emotional, and many financial decisions are based on these emotions. Some people spend more money on their homes because that is what makes them the happiest. Others spend money more money on travel because they are happiest when they do so. Some experts will say to take the emotion from the personal finance journey, but I think instead, you should use this emotion to guide your journey. I was stressed and anxious when I was in medical school and piling on six-figure debt. I was delighted the day that my wife and I paid off our large six-figure student debt. I use those memories to continue saving, investing, and teaching others to do the same. I don't want to feel stressed and anxious about money again. Hone in your emotions and figure out how you want to feel and what is most important. Like all things in life, you need a plan or process to reach your goals. In this post, I will be discussing a couple of different methods to approach saving and investing.

The first method I will discuss is the 50/30/20 rule, made famous by Elizabeth Warren in her book "All Your Worth." The idea is that 50 percent of your after-tax spending should go needs. These needs will include shelter, clothes, groceries, childcare, and essential bills like water or light. Thirty percent will go towards wants which could be anything that you don't need. You will hone on your emotions and spend money on things that bring you joy and keep you continuing to budget and avoid burnout. Lastly, 20 percent will go towards savings, investing, and paying off debt. Examples of this will be creating an emergency fund, paying off credit card debt, and investing in a 401k.

To follow the 50/30/20 rule, you must first understand where you are spending your money. This can be accomplished by reviewing your credit or debit card statements over the last three to six months. If these do not give enough information, you can track the next two months of spending using an app such as mint.com or manually keeping a record. This information will establish a baseline for your current percentages and the adjustments that need to be made to reach your 50/30/20 allocation. By following this method, you will start to see incredible progress made in your financial journey. Give yourself at least a year before choosing to increase the percentage spent on savings, debt, and investing because the key is long-term success and avoiding abandoning the process altogether.

The second method is the idea of paying yourself first. This method focuses on the needs and savings/investing/debt percentage, and the money spent on wants is a by-product of these two. You calculate first how much money you will need to pay all your essential bills. Then, you determine what percentage you will allocate for investing. Lastly, the remaining money left after paying all your bills and investing will go towards things you want. To assure success to this method, make sure that the percentage of investing/savings begins around 20-25 percent.

The keys to this method are simplification and automation. You minimize day-to-day financial decisions that could cause you to abandon your process. All your bills and debts are paid using autopay. You are investing in your companies' 401K plan pretax before you even see it, and it is the same amount each pay period. You are auto-investing with your financial institution of choice on payday and never seeing it in your bank account. This method takes the guilt out of spending money in your bank account because you have already paid your bills and invested that month. Another benefit of this method is that it removes the temptation to spend money on things you want because you never see the money in your account.

In summary, regardless of which method you choose, the key themes are to make sure that you are paying off debt, saving money, and investing every month. Always have money for things you want because this will keep you from burnout and abandoning your path towards financial independence. Use emotions in personal finance as a strength, make small changes in the right direction to your process, and don't give up.

Understanding your paycheck

The difference between what your job says you make and how much money you have to pay bills is far less than you might realize. Most working individuals are in W2 employment, in which you are an employee for a company, and this comes with certain taxes. I will discuss these taxes and help you understand your paycheck.

To discuss taxes, we must first define gross income, the amount of money you make before any taxes are taken out (what your employer says you make). You will pay federal income tax each paycheck, which is a percentage of your gross income. Currently, the national average federal income tax rate is 13-16%. In addition to federal income tax, if you live in a state with state income tax, you will pay this as well. State income tax can be either a single-rate tax structure or a graduated-rate tax structure. A single rate tax structure will tax the same percentage regardless of income, whereas the graduated rate will have an increased tax rate as income increases. Every employee will also have FICA (Federal Insurance Contributions Act) taxes. The two FICA programs specifically are Social Security and Medicare. Social Security tax is 6.2% of your gross income, and your employer pays another 6.2%. If you are self-employed, then you will owe both portions. In 2021, only $142,800 of your gross earnings is subject to this tax, but this will undoubtedly increase over time. Medicare tax is 1.45%of your gross income without a gross earnings cap. Your employer contributes another 1.45%, and if you are self-employed, you will pay both portions. There may be other taxes on your income depending on your region, but these are the most significant.

As you can see, the average working American in a state with no state income tax will remain with 80 percent of their gross income after taxes. (100-13-6.2-1.5). High-income earners at the highest tax bracket in a state with no state income tax will have 55 percent of their gross income remaining after taxes (100-37-6.2-1.5).

I understand that this is not a very exciting topic, but I discuss it to get you to think differently about just how much money you have. Start to think in terms of how much money you have left. If your company says you make 60K a year, at a minimum, start living like you make 50K because, as you now understand, this is how much money you actually have. For a physician with a gross salary of 275K, at a minimum, start living like you make 157K a year, because this is how much money you actually have.

In my next blog post, I will be discussing budgeting and the 50/30/20 rule.

How to invest in the stock market and why you should start today

Picture from Dubrovnik,Croatia

In the last few months, many have noticed that groceries and other goods have increased in price, and a dollar does not buy what it did even a few years ago. The cause is inflation, defined as a general increase in prices and a fall in the purchasing value of money. Inflation on average increases by 2% per year; therefore, if you do not invest your money, you are missing out on building wealth and losing money in the process.

Many people do not invest in the stock market either because they don't think they have the money or get analysis paralysis and don't know what to invest in. I will do my best today to debunk these two theories and empower you to start investing today.

The easiest way to begin investing in the stock market is through your job's 401k plan. Money is withdrawn from your paycheck before taxes and placed in your 401K plan each pay period. The best way to contribute to your 401K is to set up an auto-withdrawal from your company in equal amounts; that way, it takes little effort, and you avoid the temptation to spend it. The employee contribution limit is $19,500 per year and if you are 50 and older is $26,000 per year, but any amount will help your future. Since this money invested is pretax, it will decrease the amount of taxable income and save you money each year when you file your taxes. Another benefit is that some companies will match a percentage of your salary up to a maximum amount per year if you invest a certain amount. This is free money given to you by your company.

Plitvice Lakes National Park

Once you start contributing to your 401K, it can be overwhelming because there are many investment options. First, you must decide how much you will allocate to stocks and how much money in bonds. The rule of thumb is to invest your age in percent of bonds and the rest in stocks. For simplicity, you can invest in multiples of 10, so if you are 34, you can do 30% bonds. Bonds are traditionally more conservative than stocks, with fewer fluctuations in price during a bull market or a market crash. Bonds have a historically lower rate of return on your investment. Still, as you can imagine, as you near retirement, you should have most of your money in bonds to not be as affected by a market crash altering your retirement plans.

Now that you have decided how much money to allocate to bonds, we move towards the stock portion of your portfolio. Historical earnings can not predict future results, but over the last 100 years, index funds have outperformed most actively managed funds. Index funds are investments made of stocks that almost identically resemble the companies and performance of a market index such as the S&P 500, Dow Jones, or the Nasdaq. An actively managed fund is when a manager or managing team makes decisions on how to invest. Index funds have produced 8-10% historical returns per year and provide extremely low expense ratios. These expense ratios are the fees removed from your account per year to manage the account; in contrast, actively managed account fees are much higher.

Deciding which index funds can be straightforward, and I will explain a few of the most common as described in Boggleheads Guide to Investing, which represents the investment advice of John Bogle, who started the Vanguard Group an investment firm with trillions in investments. You can have a two-fund portfolio, in which you invest in a Total Stock Market Index Fund and Total Bond Market Index Fund. In doing so, you are investing in the entire U.S. equity market, with both growth and value stocks, and broad exposure to U.S. investment-grade bonds. Another option is to invest in a three-fund portfolio, adding a Total International Stock Index Fund to the previous. The Total International Index Fund invests in non-U.S. stocks, including those in developed and emerging markets. The three fund portfolio will have your age in bonds and an equal percentage in U.S. and International Index Fund. International stocks don't always rise and fall simultaneously with the domestic market, so owning both can minimize volatility.

With your 401K account now invested, it is important that you do not forget to rebalance your 401K account once a year. To rebalance your account, you buy or sell stocks to keep the exact percentages you decided upon. If you do not rebalance, you could end up with far more money in one index fund than another and deviating from your desired risk.

Dubrovnik, Croatia from above

Remember your 401K is a long-term retirement investment, as money cannot be withdrawn without penalty until you are 59.5 years old. There will be fluctuations in how much you make in your account throughout your lifetime, but it is crucial to stay the course and continue to invest every year. Do not panic sell as historically; large losses preceded the most significant gains in the stock market.

In summary, no one can predict the future, but what is for sure is that most will rely on their 401K for retirement. It is best to start early, even if you can not contribute the maximum, to allow the amount of money invested to compound. It is almost always a bad idea to pull from your 401K early as you will not only pay the penalty but miss out on more significant future earnings because you have removed from the principal. Always take advantage of free money by maxing out your 401K when possible. Do not be overwhelmed with the many investment possibilities; stay simple, and rebalance at least once a year.

529 Plan

I have discussed 529 plans with a few colleagues and thought this would be an excellent topic for this week's blog.

What is a 529 Plan

A 529 plan is a tax-advantaged savings plan created to fund educational expenses, usually for children of the account holder. The money is invested in the stock market depending on how you wish to allocate the funds. There are numerous plans throughout the different states with essential differences, and you can choose from any of these plans regardless of the state you reside in.

The most significant benefit of a 529 plan is that the after-tax contributions used to fund the account can grow tax-free, and earnings of these contributions, when used for educational expenses, are tax-free.

When you compare this to a brokerage account, in which the earnings you generate when removed are taxed at a capital gains tax of 15-20%, a 529 account is a no-brainer. Earnings made from the 529 plan and used for educational purposes are known as a qualified expense. A non-qualified expense is one in which the money in the 529 is not used for educational purposes. The money removed not used for educational purposes is subject to a 10% penalty and income tax.

Do not let the idea of a penalty scare you. The penalty and income tax will be on the earnings and not on the amount you have contributed. However, it is essential to remember that when pulling from a 529 plan, you can not just remove money from the principal. Also, before deciding against a 529 plan, I draw your attention to the incredible flexibility that the account provides.

Benefits of a 529 Plan

A 529 plan can change beneficiaries at any time. If the child you created the account for doesn't need the money for educational expenses, the funds can go to another child, grandchild, or the account holder. Educational expenses can include college, vocational, or trade school tuition and fees. A 529 plan can pay for room and board or equivalent off-campus housing. Other expenses can consist of; books and supplies, internet costs, food and meal programs, and special needs equipment, to name a few.

Other benefits of a 529 plan can include 10K per year for a private secondary and primary school in some state 529 plans and a lifetime 10K benefit per beneficiary for student loan debt. Also, if the beneficiary receives a scholarship, an equal amount can be removed from the 529 tax-free. In the unfortunate event that one files for bankruptcy, as long as the beneficiary is your child or grandchild, the money is exempt from creditors.

529 Plan Contribution Limits

The maximum one person can contribute to a 529 plan is 15K per year without paying any taxes. If the donor contributes more than this, they could be subject to a gift tax. If you are a married couple, then you can contribute 30K tax-free. If you have a relative who wishes to contribute, they can also contribute up to 15K per year. There is a loophole to this rule in that each person can technically contribute a max of 75K tax-free via a five-year gift option known as a lump sum contribution. This individual can not gift this person any more money for the next five years and must complete an IRS form 709.

Tips for choosing and funding your 529 plan

Choose a plan with high contribution limits and low minimum contributions to give you the most flexibility. It is essential to choose a plan with good investment options, including index funds. Look for additional tax benefits that some 529 plans may provide. Make sure to consider management fees when choosing your 529 plan as well, and although past performance can never predict future performance, this is something to consider as well. When funding 529 plans, the best way is to start early in the child's life and make early lump-sum contributions as time in the market beats timing the market.

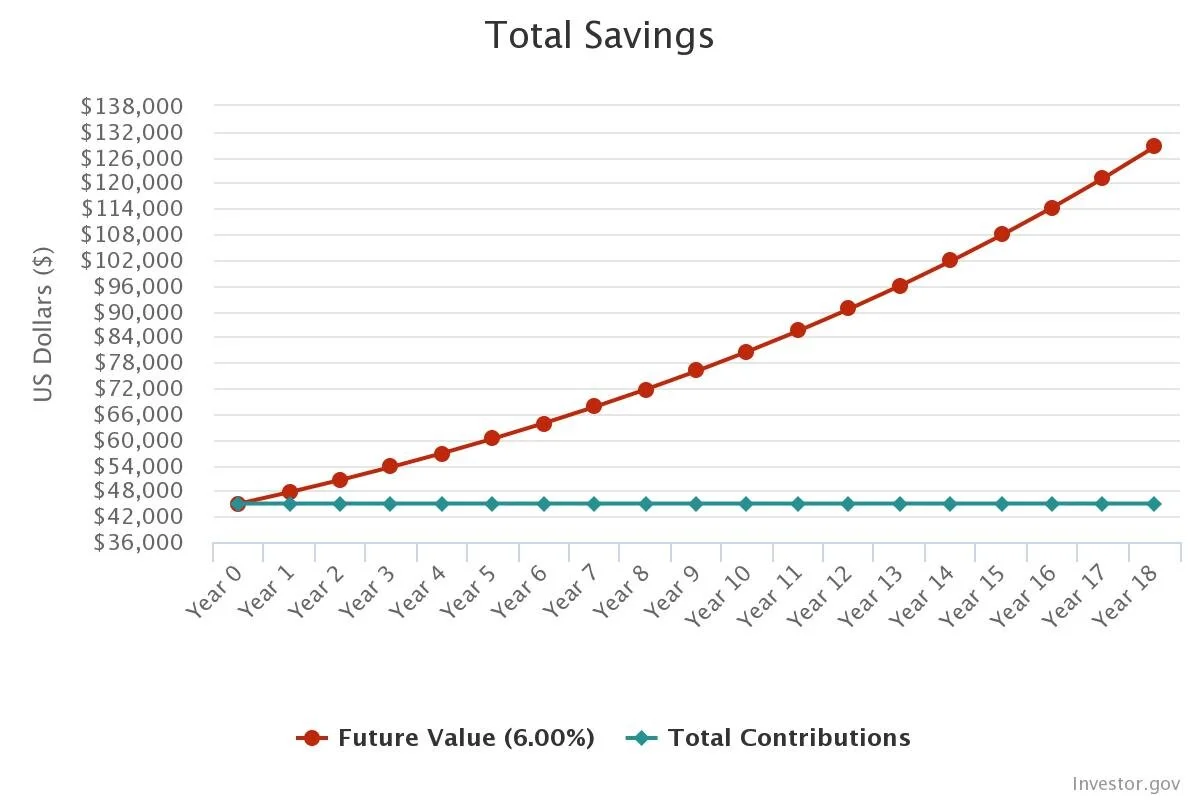

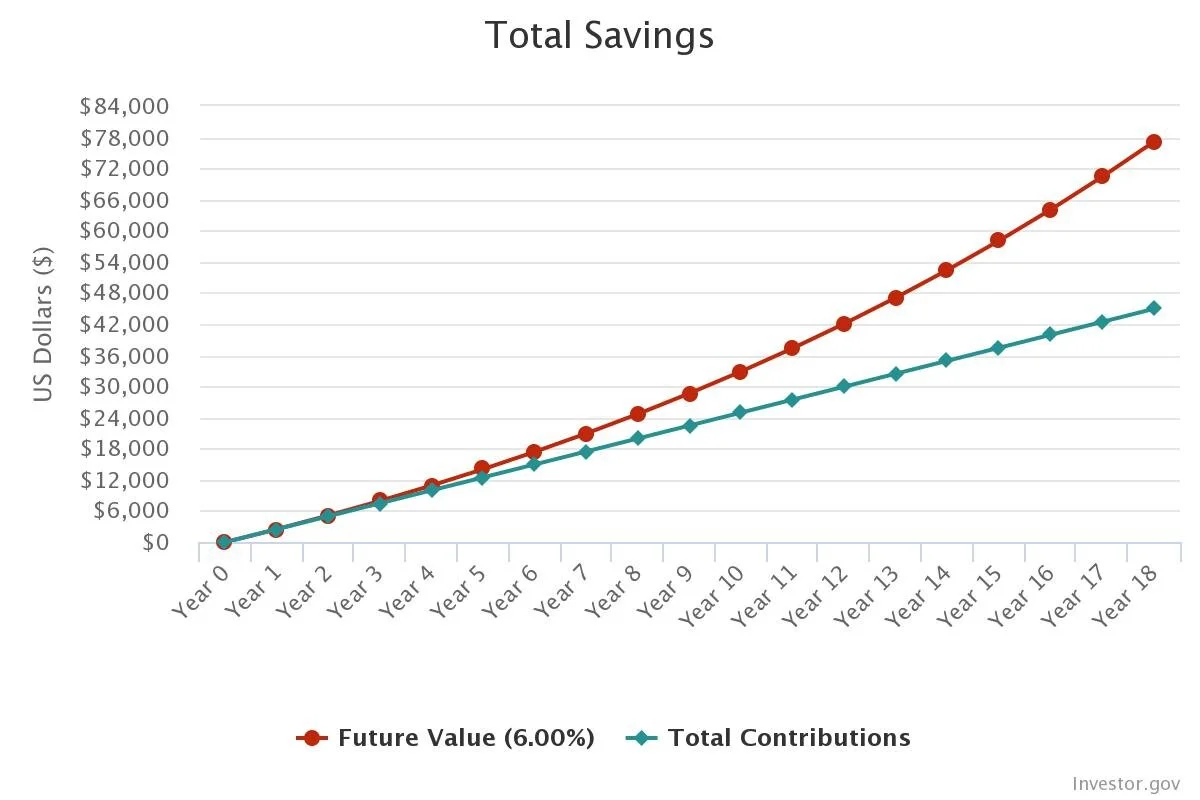

45K one time contribution at birth at 6% growth per year

45K distributed over 18 years ($208.33 a month) at 6% growth per year

Roth IRA

Last week, I spoke to a few people who mentioned that they didn't understand the benefits of having a Roth IRA investment account or didn't open an account because they didn't think they qualified. I hope to clarify why everyone who is producing income can be eligible and why everyone should have a Roth IRA account.

For 2021, if you are single and make less than 125K, you can invest a max of 6K a year into a Roth IRA. If you are married and filing a joint tax return with your spouse and make less than 198K, you can contribute 6K each. If you are over 50 years old, you can contribute up to 7K a year in both scenarios. If you make more than this, you do what is called a backdoor Roth IRA instead in which for a day you place the money in a Traditional IRA under a money market account and the next day transfer this money into your Roth IRA account. If you need help with this part, any large investment management company such as Vanguard can help.

When you put money in a Roth IRA you are using after-tax money. This money will invest in the stock market, and how you invest this money will be up to you. If you wish, you can remove your contributions to the account tax-free and without penalty at any point in time. The only difference in the backdoor Roth IRA scenario is you can not pull the money you converted from the Traditional IRA to the Roth IRA for five years. If you wish to withdraw earnings from a Roth IRA, it can also be tax-free if you have had the account for greater than 5 years and have had a qualifying event. Qualifying events include; age over 59.5, having a permanent disability, being taken by a beneficiary of your estate, or buying, building, or rebuilding your first home to a max of 10K. If you remove earnings without a qualifying event, you will pay income tax on this money and pay a 10% penalty.

The benefits of a Roth IRA are significant. The contributions invested can be removed at any time tax-free with a minor exception, as mentioned earlier, vs. a 401K, which you can not pull from until 59.5. The withdrawal on earnings can be tax-free if you have had the account for longer than five years and have had a qualifying event. If you have had the Roth IRA for 20 to 30 years, the tax-free earnings at a historical average return of 10 percent in the stock market are substantial. When you remove money from your Roth IRA, it doesn't affect your taxable income as it has already been taxed and will not move you into a higher tax bracket. This benefit is significant in retirement when you live on the income you have earned and are no longer working. Having a Roth IRA account is also a hedge against future tax rate hikes, as it has already been taxed and therefore can not be taxed at a higher rate later as opposed to 401k money, which will be taxed when you remove it.

I understand that each individual's situation regarding extra income, student debt, and risk tolerance is different. I cannot definitively say when is the best time to open a Roth IRA account, but I can offer guidance. As with most investment accounts that invest in the stock market, the sooner you invest, the better as you allow the power of compounding interest to work for you. In addition, I would also say that those in a lower tax bracket who expect to make significantly more in their mid-careers would also benefit considerably from opening a Roth IRA account ASAP. Suppose you have already maxed out your 401K, taken advantage of your employer's match and other pretax investment accounts, and are looking for another investment vehicle. I think a Roth IRA is the next step.

A tip I find helpful when funding my Roth IRA is to do this at the beginning of every year because it gives it the maximum time to grow.

Building Wealth

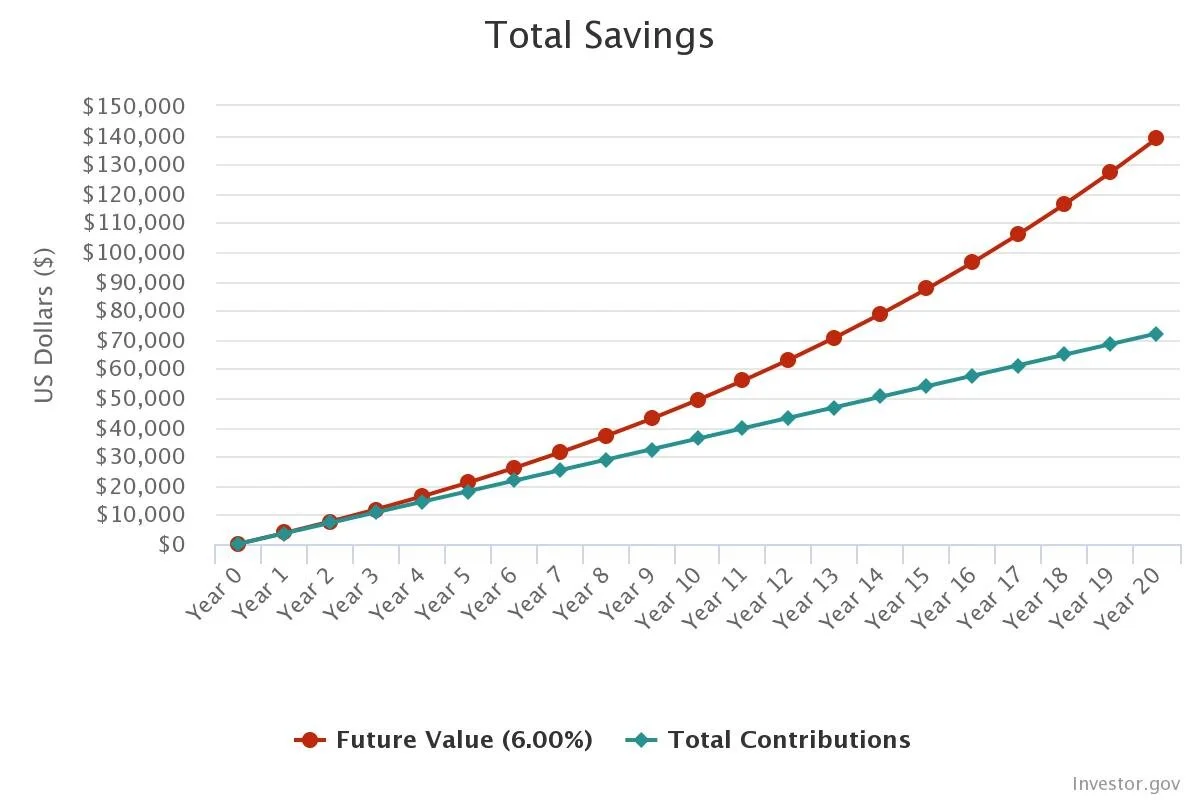

A common misconception in building wealth is that you will get there as long as you make more money. Making more money is essential, but this is only one-half of the equation. The truth is how you spend your money is just as or even more critical to building wealth. Everyone knows how much income they produce before and after taxes, yet few know how much they spend each month on bills, going out to eat, and miscellaneous expenses that come up each month. I challenge everyone to figure out how much they spend each month over the last three months to achieve a general average. Achieving this is easy by reviewing bank statements which are now so readily available online. Using this information, you can discover the net difference each month you have available to save or build wealth. To some, unfortunately, this number is negative, which means you are increasing your debt. For others, you will see that the difference between how much you make and how much you save is a lot less than you thought. With this vital information in hand, the fun begins as you work towards widening the gap between how much you make and how much you spend. Use mint.com or other online trackers to track your expenses and keep you on the right path. It can be a daunting task to track every purchase, so I would begin with the three most costly items on your expenses list, as these have the most significant impact on your budget. To most, this is home, childcare, and eating out or vehicle. Given historically low interest rates, refinancing your home might be a good option. If you have an expensive car payment, consider looking for a used car or a cheap lease. Given how expensive it is to eat out these days with extra fees added to your bill, this could easily cut down your expenses. It will not seem like a lot at first, but as you see below, just 300$ per month invested goes a long way over 20 years in the stock market at an average 6 percent return. This amounts to 139,000$ and all you contributed was 72,000$.

The power of compounding interest.

Where it all begins

Today marks the first post on this site as I begin to help others on their path to financial success. It is an unprecedented time in our lives due to COVID-19, and unfortunately many have been effected financially and physically. As a physician, I have seen first hand what this virus has done, and I feel for those who have lost a loved one. I am grateful to still have my health, and have started this blog because upon reflecting upon what else I could do for the community, I kept coming back to teaching personal finance. Many people are without jobs as I write this today and many have seen a reduction in pay. Now more than ever is it important to learn the tools necessary to achieve financial success. I had off today so I enjoyed spending time with my wife and my two dogs Sadie and Nalu. I also spent today listening to “Set for Life,” a personal finance book as I continue to further educate myself on this topic. In addition, I wrote a script for “Understanding Money,” a YouTube video that should be published in the next few days. My first financial advice to all newcomers reading my blog today would be to choose your spouse carefully. It will be one of the single most important decisions you will make towards realizing your financial goals. I am lucky that I have a supporting wife who sees eye to eye with me regarding the steps necessary towards reaching financial freedom, but not having this can be a huge downfall. Overspending, financial infidelity, divorce, and alimony are just a few things that can seriously impair your chance at financial success. It is important to have open communication with your significant other regarding finances and involve them regarding future decisions and budget meetings. I hope you learn something by reading my blogs, watching my youtube videos, and may you achieve your financial goals.