Building Wealth

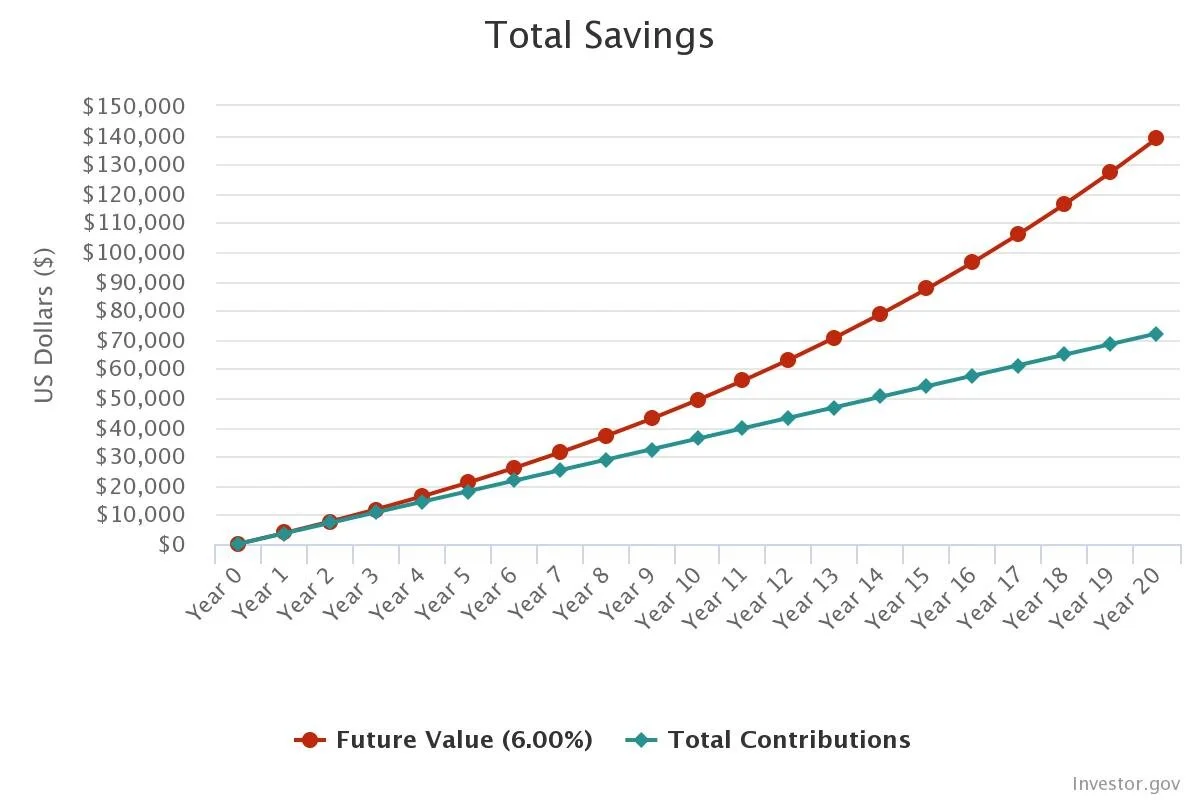

A common misconception in building wealth is that you will get there as long as you make more money. Making more money is essential, but this is only one-half of the equation. The truth is how you spend your money is just as or even more critical to building wealth. Everyone knows how much income they produce before and after taxes, yet few know how much they spend each month on bills, going out to eat, and miscellaneous expenses that come up each month. I challenge everyone to figure out how much they spend each month over the last three months to achieve a general average. Achieving this is easy by reviewing bank statements which are now so readily available online. Using this information, you can discover the net difference each month you have available to save or build wealth. To some, unfortunately, this number is negative, which means you are increasing your debt. For others, you will see that the difference between how much you make and how much you save is a lot less than you thought. With this vital information in hand, the fun begins as you work towards widening the gap between how much you make and how much you spend. Use mint.com or other online trackers to track your expenses and keep you on the right path. It can be a daunting task to track every purchase, so I would begin with the three most costly items on your expenses list, as these have the most significant impact on your budget. To most, this is home, childcare, and eating out or vehicle. Given historically low interest rates, refinancing your home might be a good option. If you have an expensive car payment, consider looking for a used car or a cheap lease. Given how expensive it is to eat out these days with extra fees added to your bill, this could easily cut down your expenses. It will not seem like a lot at first, but as you see below, just 300$ per month invested goes a long way over 20 years in the stock market at an average 6 percent return. This amounts to 139,000$ and all you contributed was 72,000$.

The power of compounding interest.