529 Plan

I have discussed 529 plans with a few colleagues and thought this would be an excellent topic for this week's blog.

What is a 529 Plan

A 529 plan is a tax-advantaged savings plan created to fund educational expenses, usually for children of the account holder. The money is invested in the stock market depending on how you wish to allocate the funds. There are numerous plans throughout the different states with essential differences, and you can choose from any of these plans regardless of the state you reside in.

The most significant benefit of a 529 plan is that the after-tax contributions used to fund the account can grow tax-free, and earnings of these contributions, when used for educational expenses, are tax-free.

When you compare this to a brokerage account, in which the earnings you generate when removed are taxed at a capital gains tax of 15-20%, a 529 account is a no-brainer. Earnings made from the 529 plan and used for educational purposes are known as a qualified expense. A non-qualified expense is one in which the money in the 529 is not used for educational purposes. The money removed not used for educational purposes is subject to a 10% penalty and income tax.

Do not let the idea of a penalty scare you. The penalty and income tax will be on the earnings and not on the amount you have contributed. However, it is essential to remember that when pulling from a 529 plan, you can not just remove money from the principal. Also, before deciding against a 529 plan, I draw your attention to the incredible flexibility that the account provides.

Benefits of a 529 Plan

A 529 plan can change beneficiaries at any time. If the child you created the account for doesn't need the money for educational expenses, the funds can go to another child, grandchild, or the account holder. Educational expenses can include college, vocational, or trade school tuition and fees. A 529 plan can pay for room and board or equivalent off-campus housing. Other expenses can consist of; books and supplies, internet costs, food and meal programs, and special needs equipment, to name a few.

Other benefits of a 529 plan can include 10K per year for a private secondary and primary school in some state 529 plans and a lifetime 10K benefit per beneficiary for student loan debt. Also, if the beneficiary receives a scholarship, an equal amount can be removed from the 529 tax-free. In the unfortunate event that one files for bankruptcy, as long as the beneficiary is your child or grandchild, the money is exempt from creditors.

529 Plan Contribution Limits

The maximum one person can contribute to a 529 plan is 15K per year without paying any taxes. If the donor contributes more than this, they could be subject to a gift tax. If you are a married couple, then you can contribute 30K tax-free. If you have a relative who wishes to contribute, they can also contribute up to 15K per year. There is a loophole to this rule in that each person can technically contribute a max of 75K tax-free via a five-year gift option known as a lump sum contribution. This individual can not gift this person any more money for the next five years and must complete an IRS form 709.

Tips for choosing and funding your 529 plan

Choose a plan with high contribution limits and low minimum contributions to give you the most flexibility. It is essential to choose a plan with good investment options, including index funds. Look for additional tax benefits that some 529 plans may provide. Make sure to consider management fees when choosing your 529 plan as well, and although past performance can never predict future performance, this is something to consider as well. When funding 529 plans, the best way is to start early in the child's life and make early lump-sum contributions as time in the market beats timing the market.

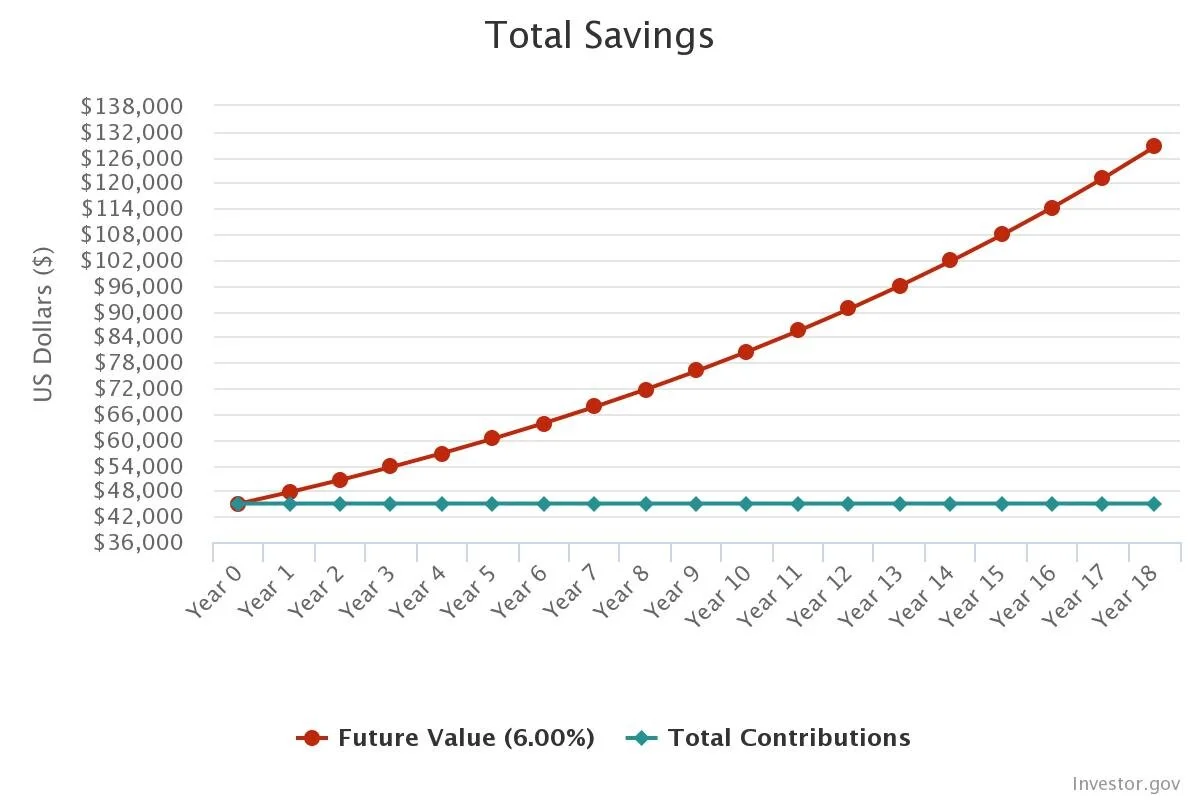

45K one time contribution at birth at 6% growth per year

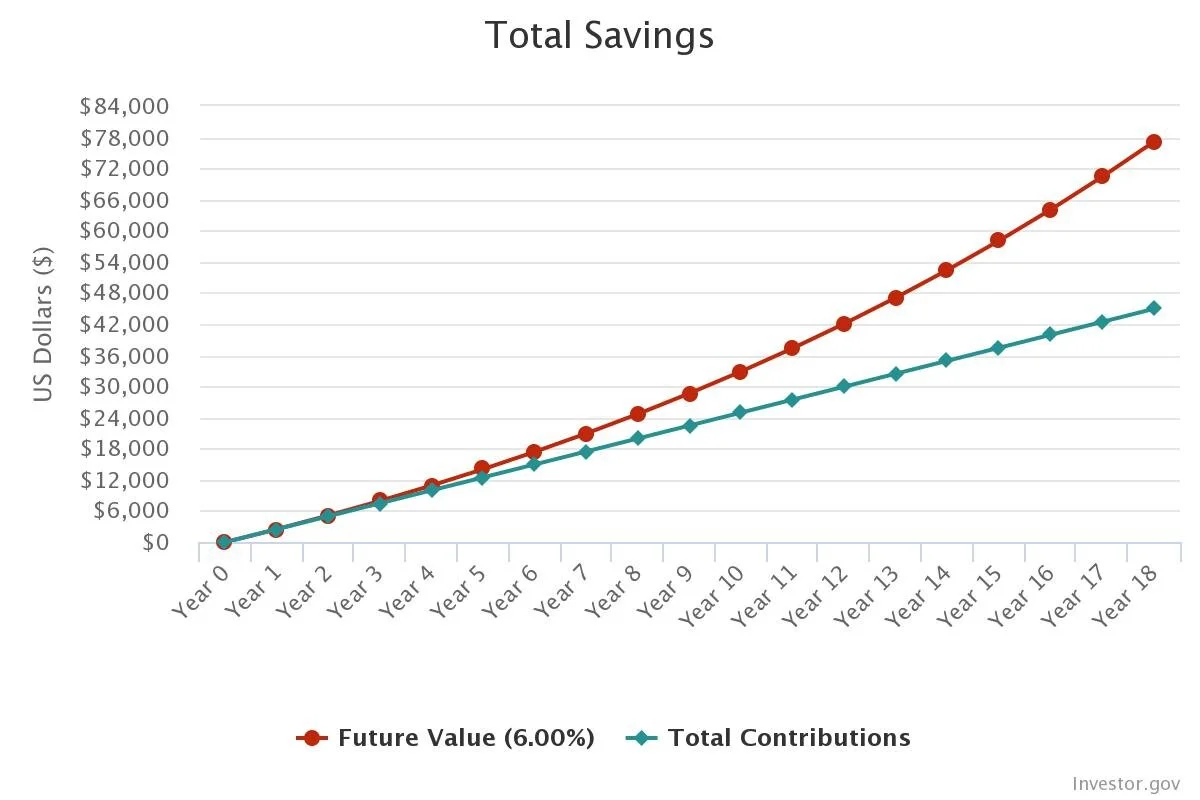

45K distributed over 18 years ($208.33 a month) at 6% growth per year